Yee haw cowpokes!! Only rodeo bull or bronc riders might appreciate the volatility and machinations of the current

stock and real estate markets going into what promises to be an uncertain 2019.

Rising interest rates. Bulls fighting Bears. Trade wars. Cohen and Pecker flip. Mattis resigns. More to come...Impeachment?

Mueller’s poker hand revealed? House investigations?

Will Trump”s erratic, diversionary and mostly inaccurate tweeting

continue? Probably. Or will the House’s incoming political counterbalance coupled with beginning of the 2020 presidential

campaign provide some sanity? Not likely.

The milieu of domestic and

international challenges is daunting, with much concern for

the potential fallout on what has been a decade long economic recovery.

The milieu of domestic and

international challenges is daunting, with much concern for

the potential fallout on what has been a decade long economic recovery.

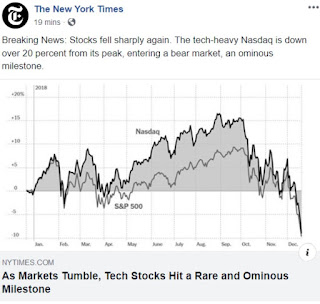

As for stocks, the recent dramatic swings up

and down are enough to bring shivers to any investor portolio. The Dow Jones

average, S&P 500 and other tracking indexes are essentially back at the

January starting line for the year.

But a New York Times report noted that

as of Dec. 10 the S&P 500 remained 16% above its level at Trump’s inauguration

(remember that biggest crowd ever?).

|

| December 21, 2018 |

The current stock malaise dovetails

with a softening of the housing market after years of the current upward arc

since the “Great Recession.”

One telling indicator is the

Seattle-King County housing market, the Northwest's largest, which for much of recent years was leading

the appreciation pack of major metro areas.

New statistics from the Northwest

Multiple Listing Service show the November median price of a single family home

in King County was $644,000 compared with $726,000 in May, a drop of 11.3%.

That’s edging toward the 14% drop that occurred in the housing collapse beginning

at the end of the previous decade.

At its peak of the past two years the

Seattle area market was a frenzy of multiple offers for properties, often with

all cash and no inspection or financing contingencies.

The Seattle Times reports that, even

with still-pricey closings, days on the market have extended, inventory is up

and sales are slumping as buyers enjoy the luxury of caution to do more research

and wait out developing trendlines.

Narrowing the focus to Bend, Beacon

Appraisal’s December report covering October through November 2018 notes a November median single family home price at $433,000,

the same as October but up from $425,000 in September.

The highest monthly median for the

past 12 months was $449,000 in June, which topped June of 2017 by $40,000.

Perhaps a more meaningful gauge of

market direction is the 12- month rolling median which at the end of November

was $424,000, 7.47% above the $395,000 for the same period of 2017.

Total sales for the 12 months ending

in November were 2,484 with currently active listings of 435, which translates

to inventory of two months, the same as for the period through Ocober.